Though the likelihood of a church being audited is low, churches still must follow IRS guidelines carefully, so it’s important to be familiar with each new year’s changes.

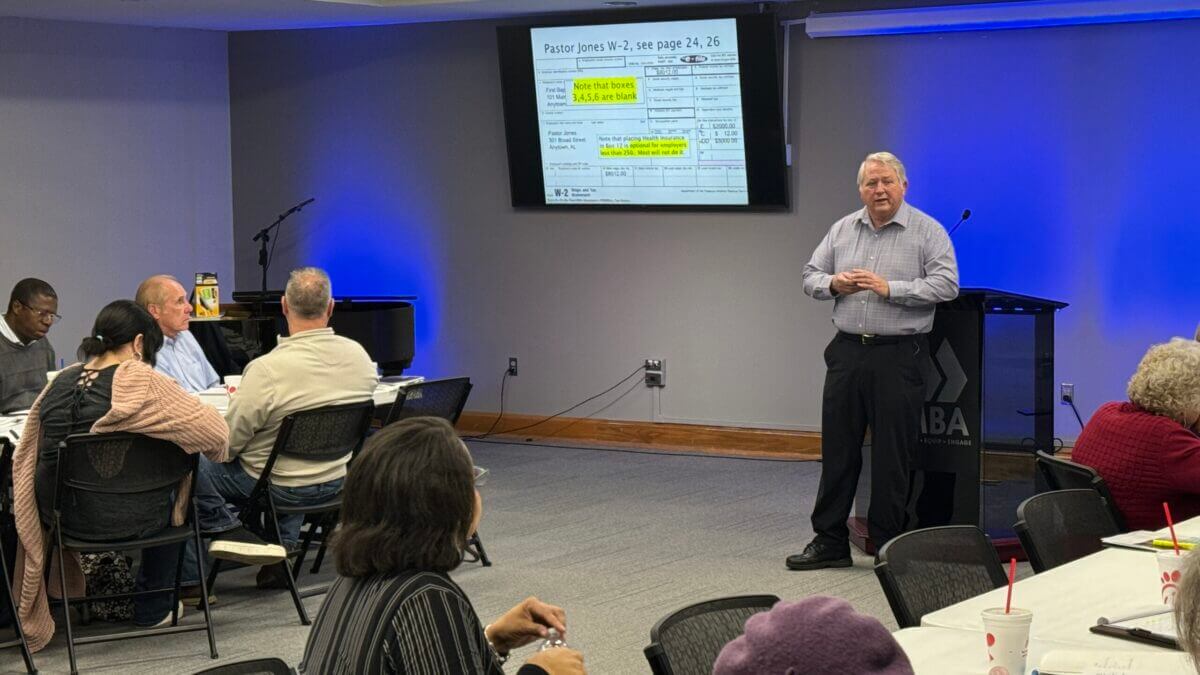

Lee Wright, church compensation specialist for the Alabama Baptist State Board of Missions, directed a church tax conference at the Birmingham Metro Baptist Association on Jan. 11, one of four such workshops he’s offering throughout the state this year.

One new point related to giving is the federal standard deduction for married couples, which rises to $29,200 in 2024.

“Most taxpayers will still itemize for Alabama income tax, but about 95% of taxpayers don’t itemize anymore for their federal taxes,” Wright said.

Wright also reminded attendees that church contribution records must be “contemporaneous.”

“This means that our members should wait until they have the contribution statement in hand before they file their taxes if they plan to itemize,” he said. “I suggest churches declare this in their printed materials in January as a reminder.”

Continue reading here.

This article was originally published at TheAlabamaBaptist.org.

by Dogwood

by Dogwood