Category: Church Compensation

2024 tax law changes bring important reminder to stay informed of regulations

Though the likelihood of a church being audited is low, churches still must follow IRS guidelines carefully, so it’s important to be familiar with each new year’s changes. Lee Wright,

Social Security COLA, Comp Study and Other Financial News

The Social Security Administration announced that the cost-of-living adjustment will be 8.7 percent in 2023. The announcement also stated, “Medicare premiums are going down and Social Security benefits are going

2022 Church Staff Compensation Study Survey

The Church Staff Compensation Study is a joint effort involving GuideStone, Lifeway and the state conventions. GuideStone conducts the survey, LifeWay tabulates the results and the State Board of Missions

Church personnel teams should advocate for staff

The goal of every church personnel team should be to become more effective and to be an advocate for church staff, according to an Alabama state missionary. “Who else is

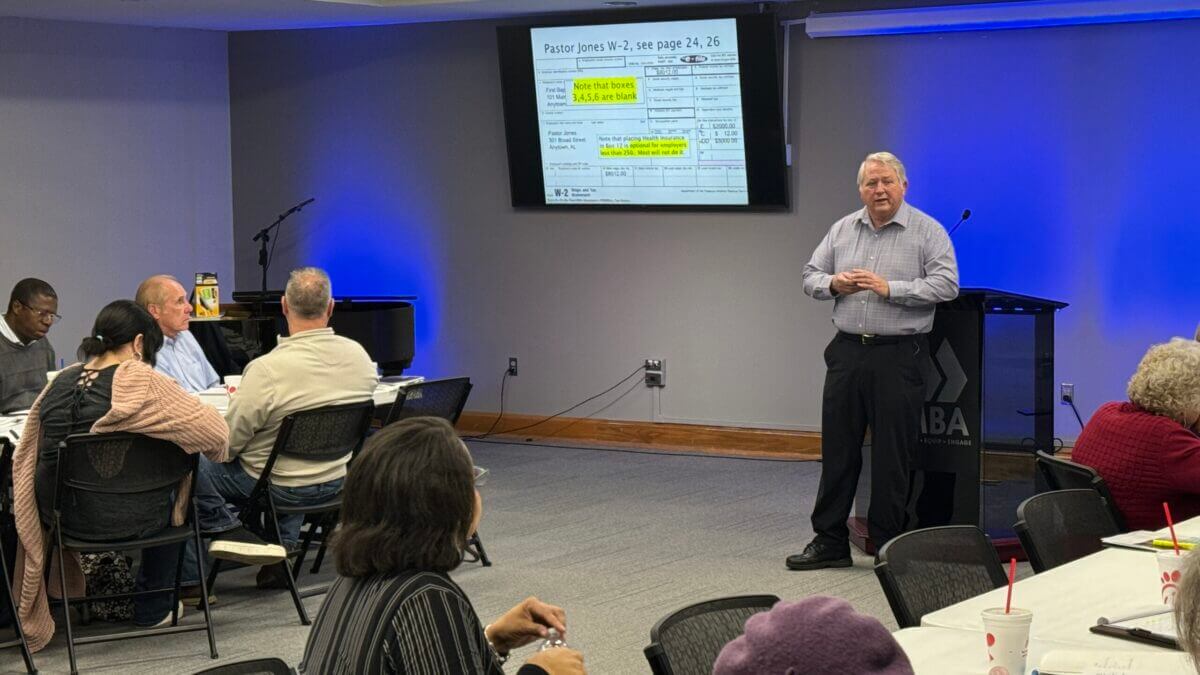

Church Tax Conference for Small Churches

Lee Wright All right, good morning, everybody. Let’s begin with a word of prayer. And I hope that we have a great morning. And you feel free to ask questions

Financial Issues in Challenging Times

Mike Jackson Well good morning everyone. It’s good to see you today. Glad you joined us for this Leader Care and Church Health Webinar. I’m Mike Jackson, director of the

A Quick Opinion of the Cares Act

THIS IS OPINION AND IS NOT LEGAL OR FINANCIAL ADVICE. FOR LEGAL OR FINANCIAL ADVICE, SEE A COMPETENT PROFESSIONAL IN THE FIELD OF YOUR INTEREST. PART I. RECOVERY REBATES Pastors

Financial Issues Workshops Offer Help to Churches

I recently signed up for Medicare. I began by using the online application right up to the point of submission and then due to a question, made an appointment. This gave

Cost concerns: churches, pastors face questions about pay, insurance and benefits

As Mike Jackson travels around the state meeting with churches in transition, he says one question comes up more and more frequently than any others. “What I’m seeing is a

by Dogwood

by Dogwood